Are You Overwhelmed by Financial Planning? The Answer Lies in Getting Started the Right Way

Financial planning isn’t just about numbers and spreadsheets—it’s about peace of mind, clarity, and the future you want for yourself and your loved ones. But for many, even the phrase “financial planning” raises questions: Where do I start? How do I set priorities? Is it too late, or too early, to make a difference? The truth is, whether you’re managing a growing career, planning for your children’s education, or eyeing a comfortable retirement, having a strategy makes all the difference between feeling lost and feeling in control.

Today, confusion about financial planning is widespread. According to national surveys, fewer than 30% of Americans have a comprehensive written financial plan, and many admit feeling unprepared for emergencies or significant life events. The consequences of inaction go beyond simple budgeting; they can mean uncertainty, lost opportunities, and even increased personal stress. That’s why empowering yourself with financial planning knowledge—and understanding how tailored strategies can unlock new possibilities—matters now more than ever. This guide breaks down why financial planning is essential, the tangible benefits it delivers, and practical ways you can rethink your approach for lasting results.

From Concept to Clarity: Why Financial Planning is the Cornerstone of a Fulfilling Life

At its core, financial planning is the process of defining your life goals and mapping out how to use your financial resources to achieve them. The process goes far beyond choosing where to invest or how to save; it involves analyzing every aspect of your financial life—from cash flow and debt to insurance and taxes. It’s about making informed choices now that will help you live the life you want, not just today, but decades into the future. Without proper financial planning, even high earners can find themselves struggling to meet their goals, while those with more modest means may miss key opportunities to grow and protect what they have.

Comprehensive financial planning covers a range of topics: saving for college, preparing for retirement, ensuring adequate insurance coverage, crafting estate plans, and planning for unexpected events. But here’s the challenge: many people don’t know what they don’t know. Misconceptions about planning can lead people to rely on ad hoc decisions—reacting instead of preparing. This approach can result in costly mistakes or missed opportunities. Education is crucial because understanding the “why” behind each step transforms overwhelming decisions into manageable actions. By demystifying financial planning, individuals can take charge of their futures and confidently navigate the milestones and surprises that life brings.

Why Personalized Financial Planning Changes Lives, Not Just Numbers

Expert guidance in financial planning offers more than standard advice—it provides a strategic roadmap adjusted to each individual’s evolving circumstances. Drawing on years of experience and a deep understanding of holistic planning, industry-leading advisors emphasize the importance of seeing the big picture. It’s not about selling products, but rather about helping clients clarify their financial values and align every decision with long-term goals. The right plan allows individuals to move from uncertainty to clarity, ensuring that each step—whether starting an investment portfolio or preparing for retirement—is grounded in sound strategy.

The outcomes of robust financial planning can be profound: less worry about sudden expenses, more confidence in meeting milestones such as education or retirement, and an overall sense of security. Incorporating personalized advice increases the chances of creating a tailored action plan, taking advantage of tax efficiencies, maximizing savings growth, and preparing for the unpredictable. When people understand that financial planning is not a one-size-fits-all endeavor, but an ongoing partnership shaped by regular review and adjustment, the process becomes empowering rather than intimidating.

Building a Financial Foundation: The Consequences of Going Without a Plan

One of the most overlooked risks in personal finance is failing to have a deliberate plan in place. Many families and individuals operate without a clear roadmap, only to realize—sometimes too late—that their financial trajectories are vulnerable to setbacks. Without disciplined budgeting, emergency fund planning, or long-term investment goals, the typical response to adversity can be reactive, fueled by stress or misinformation rather than confidence and clarity. Lacking a plan often means missing out on the benefits of compound growth, tax advantages, or protection from the unexpected.

For example, skipping college savings plans or neglecting adequate insurance coverage can directly impact family security. Delaying retirement contributions may leave individuals working longer than intended, or retiring with less than needed for their ideal lifestyle. These are not rare occurrences—they are everyday issues faced by those who underestimate the power of intentional financial planning. The fix lies not in drastic changes overnight, but in taking the first step to create a practical, adaptable, and personal plan, tailored to your specific needs and aspirations.

Transforming Dreams into Reality: Practical Steps for Effective Financial Planning

Taking control of your finances starts with a few simple, yet highly impactful steps. First, clarify your goals—both short-term and long-term. Are you saving for a home, college tuition, or a comfortable retirement? Next, assess your current financial landscape by tracking income, spending, debts, and savings. This snapshot forms the backbone of every effective financial strategy. It allows you to prioritize needs versus wants, making more informed choices as your circumstances change.

From here, the value of working with a knowledgeable advisor becomes clear. Guidance from financial experts helps with investment selection, risk management, and regular plan reviews to ensure you stay on track even as life changes. Accountability and ongoing education form part of the process, empowering you to make informed adjustments, recognize new opportunities, and protect yourself from pitfalls. By taking these actionable steps, individuals lay a durable foundation that sustains them through both everyday decisions and major life milestones.

Why Knowledgeable Advisors Make a Measurable Difference in Financial Planning Outcomes

The field of financial planning is more than a set of technical skills—it’s about building lasting relationships, trust, and understanding the complexities behind each financial decision. From the initial drafting of a plan to its ongoing refinement, client-focused advisors stand out by offering holistic support that adapts as needs evolve. They blend technical expertise, deep listening, and a genuine desire to serve, creating an environment where clients feel empowered.

Rather than relying solely on market predictions or product recommendations, a forward-thinking advisor partners with you to address life’s full financial picture—assets, liabilities, risk, and legacy. Their role is to equip every client with education and a voice in the decision-making process, which leads to better financial habits, increased confidence, and more successful outcomes. In this way, experienced advisors play an invaluable role as both educators and advocates, bringing a sense of order and possibility to even the most complex financial situations.

Guided By Values: Kehoe Financial Advisors’ Approach to Financial Planning

Kehoe Financial Advisors approaches financial planning with the belief that quality advice stems from truly understanding each client’s unique needs and aspirations. Their philosophy is rooted in building relationships and fostering trust—core values that shape every strategy they create. According to their practice, successful planning is not a one-time event but an ongoing partnership that adjusts with life’s changes. They emphasize the importance of holistic consideration, where every financial strategy is tailored to the specific circumstances and long-term goals of each client.

This mission-driven, client-focused approach is evident in the way Kehoe Financial Advisors invests in ongoing education for both clients and staff, striving for clarity, not confusion. Each advisor offers their expertise as an “advocate and partner,” seeking to empower clients with the knowledge and confidence needed to make sound decisions for their futures. The commitment to personalized guidance, regular communication, and genuine care sets a high standard in the world of financial planning—one that ensures clients have both a safe foundation and room to grow, regardless of where they start on their financial journey.

The Power of Trust: Real Experiences in Financial Planning

For many, personal stories and experiences offer the strongest affirmation of the benefits of expert financial planning. One client described their journey, highlighting the attentive, knowledgeable, and caring guidance received over several years. These reflections underline the critical role a compassionate advisor plays—not just technically crafting a plan, but becoming a true advocate and partner through each stage of life.

I have worked with Erin on my personal financial planning for the last several years. She is very knowledgeable, professional & most importantly very caring. She takes the time to look at the whole picture & create a plan that works for the individual situation. She will be your advocate & partner. Highly recommend.

Real stories like these illustrate how working with the right advisor transforms anxiety into clarity, and confusion into concrete results. Those willing to take the first step consistently find that trusted guidance makes tackling financial planning more approachable—and their victories more meaningful.

Why Embracing Financial Planning Is Your Key to a Brighter, More Secure Future

Strategic financial planning offers more than just numbers; it offers a structured path to achieving personal goals, security, and peace of mind. When rooted in expert advice and a client-focused philosophy, financial planning can turn uncertainty into opportunity, empowering individuals and families to thrive no matter what challenges arise. The industry’s most respected experts, like those at Kehoe Financial Advisors, contribute to a culture of clarity and confidence—demonstrating that a well-conceived financial plan is the surest step toward lasting fulfillment and stability. For anyone feeling uncertain about where to start, now is the time to act, learn, and shape your financial future.

Contact the Experts at Kehoe Financial Advisors

If you’d like to learn more about how financial planning could benefit your financial future, contact the team at Kehoe Financial Advisors.

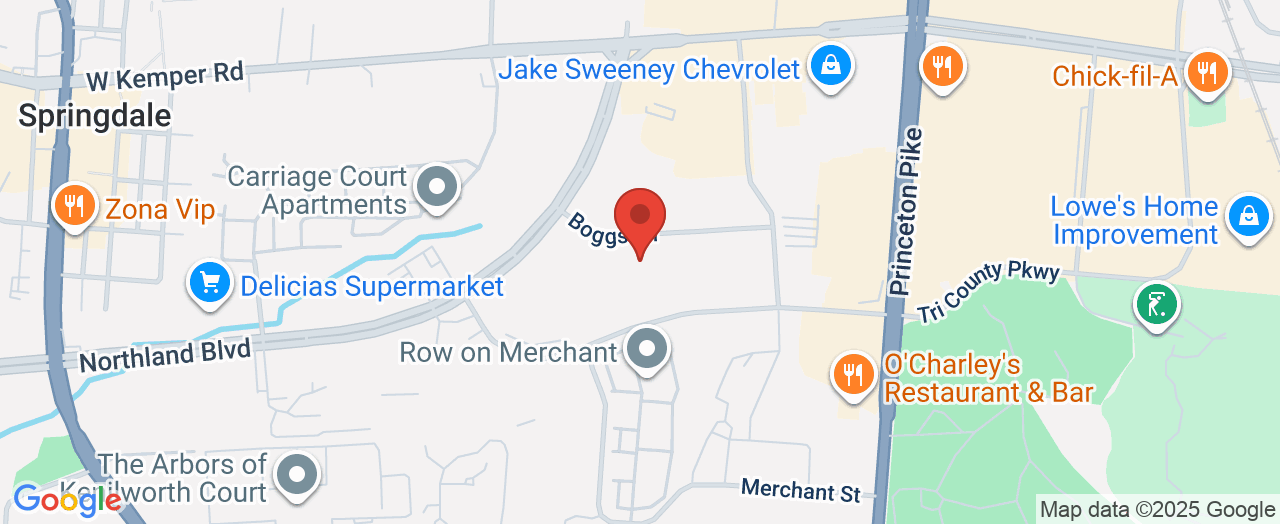

📍 Address: 125 Boggs Ln, Cincinnati, OH 45246

📞 Phone: +1 513-481-8555

🌐 Website: http://www.kehoe-financial.com/

Kehoe Financial Advisors Location and Hours

🕒 Hours of Operation:

📅 Monday: 8:00 AM – 5:00 PM

📅 Tuesday: 8:00 AM – 5:00 PM

📅 Wednesday: 8:00 AM – 5:00 PM

📅 Thursday: 8:00 AM – 5:00 PM

📅 Friday: 8:00 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment