Why Most People Miss Out on the Power of Financial Planning

Do you ever wonder why some people seem effortlessly prepared for life’s biggest financial events—while others stumble at every turn? Many families and individuals postpone conversations about budgeting, investments, and long-term security until it’s almost too late. Yet research shows that proactive financial planning dramatically increases confidence, reduces stress, and offers a buffer against unexpected setbacks. Imagine facing life’s big moments—like a new home purchase, career change, or even retirement—with a sense of readiness instead of anxiety. For anyone asking, “Is it really necessary?” the answer is a resounding yes.

Financial planning is more than a to-do list or a collection of spreadsheets. It is a structured approach for managing income, expenses, goals, and risks. But most people simply don’t know where to begin, especially when financial jargon and complex products create a sense of overwhelm. This confusion can result in costly mistakes—like missed investment opportunities, insufficient insurance coverage, or delayed retirement. That’s why understanding the fundamentals of financial planning can be a transformative first step. Readers who grasp its core value soon discover that it is not just a one-time task, but a lifelong tool that shapes security, opportunity, and peace of mind.

Financial Planning: The Roadmap That Shapes Your Entire Financial Journey

At its heart, financial planning is about making intentional decisions to safeguard your money and align your resources with your deepest priorities. It goes far beyond simply tracking monthly spending or picking stocks. A solid financial plan establishes goals, monitors progress, and proactively adjusts strategies in response to life changes. By approaching finances in a holistic, structured way, individuals put themselves in the driver’s seat—rather than reacting to circumstances as they arise. Financial planning ensures every dollar has a purpose, guiding you step by step from today’s budget to tomorrow’s dreams.

Ignoring the essentials of financial planning increases the risk of “financial drift”—where money decisions are made haphazardly, without a clear path or safety net. This can lead to dangerous pitfalls: forgotten debts, insufficient savings, or financial emergencies with no rescue plan. Without a thoughtful approach, major life milestones—such as sending kids to college, starting a business, or enjoying a secure retirement—can slip out of reach. For these reasons, financial planning stands out as a powerful tool not only to build wealth but also to prevent setbacks and disappointments. Learning how to map out and monitor your financial life is a step few regret—and most wish they had taken sooner.

How Financial Planning Transforms Confidence, Security, and Peace of Mind

Turning to advisory experts like Artifex Financial Group brings clarity and reliability to the financial planning process. By working with a firm that practices fee-only planning, clients know that advice is given with their best interests at heart—not as a commission-driven sales pitch. This fiduciary approach translates into greater trust, objective recommendations, and strategies that adapt to individual goals and values.

The benefits of financial planning are numerous and far-reaching. A carefully crafted plan allows you to track progress toward goals such as homeownership, retirement savings, or a child’s education without losing sight of day-to-day realities. It helps create emergency funds, manage risk, and develop investment habits that weather economic ups and downs. Ultimately, those who embrace expert-guided financial planning describe a newfound peace of mind—knowing that their finances, and by extension their families, are better protected against life's uncertainties.

In today’s uncertain world, the value of real financial planning doesn’t just lie in dollars and cents. It brings clarity, confidence, and the empowerment to make life choices free from financial anxiety. By being intentional, making informed decisions, and leaning on trusted guidance, anyone can transform their relationship with money for the better.

From Procrastination to Preparedness: Why Knowledge is Your Greatest Financial Asset

Taking the first step toward financial planning can feel daunting, but hesitating is often the costliest move of all. Those who educate themselves—even at a basic level—gain insight into their own habits, motivations, and gaps in coverage or savings. This sparks a cycle of positive improvement: identifying challenges, addressing them head-on, and adjusting plans over time for maximum benefit.

One of the most empowering outcomes of financial planning is the ability to anticipate and absorb life’s changes confidently. Rather than scrambling when faced with layoffs, medical emergencies, or market volatility, those with a plan already in place know what resources they can tap into. They have financial goals laid out, timelines in mind, and strategies for overcoming obstacles. Knowledge makes all the difference between merely surviving and actively thriving through life’s inevitable ups and downs.

Adapting to Change: How Ongoing Planning Protects Against Life’s Surprises

A standout feature of modern financial planning is its adaptability. Life is notorious for unexpected twists—marriage, divorce, career changes, and health scares can all shift priorities in an instant. With a living, breathing financial plan, individuals regularly revisit and revise their strategies to stay aligned with new realities. Plans become roadmaps that never fully set, but evolve alongside each stage of life.

This ongoing process is where expert guidance proves invaluable. By evaluating regular progress and weighing new options as circumstances shift, people protect themselves from being blindsided by large expenses or unplanned risks. Whether it’s adjusting investment allocations, updating insurance, or rethinking retirement, an evolving financial plan gives both security and flexibility—two qualities essential in today’s unpredictable world.

Holistic Planning: Bridging Today’s Decisions with Tomorrow’s Aspirations

Thoughtful financial planning goes beyond immediate choices and short-term fixes. Holistic planners examine every aspect of a person’s financial life, connecting current spending, debt, savings, insurance, and investments to long-range dreams. This approach ensures that one decision—say, buying a car or taking out a loan—fits harmoniously within a larger vision for family security and personal fulfillment.

Comprehensive planning builds a sturdy foundation, allowing individuals to make choices confidently and intentionally, knowing each step supports long-term goals. When all pieces of the financial puzzle are aligned, clients report greater satisfaction, fewer regrets, and a tangible sense of progress. Most importantly, holistic planning replaces anxiety about the future with optimism and motivation to keep moving forward.

Artifex Financial Group’s Guiding Principles and Advisory Approach

At Artifex Financial Group, the advisory process revolves around clarity, transparency, and lasting client relationships. As a fee-only firm, all recommendations and strategies are tailored exclusively in the best interest of clients—removing conflicts of interest and building deep trust. This approach ensures that every decision, from investment selection to retirement planning, is aligned solely with client goals rather than outside pressures.

Artifex Financial Group stands out for its consultative, educational philosophy. Their practice centers on demystifying financial concepts, providing clients with actionable knowledge, and empowering them at every stage of life. The team brings a professional, instructive tone to each conversation—simplifying complex choices and establishing an environment where clients feel comfortable, informed, and engaged. Their commitment to transparency and careful guidance exemplifies what a modern financial planning relationship should look like.

By emphasizing open communication, ongoing education, and truly individualized advice, Artifex Financial Group helps clients navigate the challenges and opportunities of personal finance. This advisory style not only promotes stronger outcomes, but nurtures a sense of partnership and mutual respect—qualities that define long-term financial security.

Real Trust, Real Outcomes: A Client’s Perspective on Financial Planning Success

For many people, the true test of a financial adviser lies in the comfort, trust, and security they inspire. Thoughtful planning, combined with guidance that is transparent and tailored to the client, yields success stories that speak for themselves. The experience of real clients illustrates the value—and peace of mind—that can emerge from expert, unbiased advice.

I trust in Artifex with all my Money and my future security for my family. Their fee only practice is what I wanted in a planner, I truly feel comfortable with them handling my money.

When clients feel truly heard, understood, and protected, the results extend beyond numbers on a page. Feedback like this echoes the satisfaction and confidence others can expect when they make the decision to prioritize financial planning with a trusted, transparent firm. Taking the step to work with an expert yields both personal security and greater peace of mind for one’s loved ones.

Financial Planning: The Quiet Revolution Shaping Secure Futures

As financial challenges and opportunities continue to evolve, the value of financial planning grows even more significant. Embracing clear, ongoing guidance from professionals like Artifex Financial Group helps individuals and families gain control over their financial destinies—while removing confusion and worry along the way. In today’s world, the thoughtful practice of financial planning is not a luxury, but a necessity that builds lasting peace of mind and confidence.

By adopting a consultative, fee-only approach and prioritizing clear communication, Artifex Financial Group has earned its place as a trusted voice in financial planning. For anyone looking to unlock their true potential and create a secure, adaptable financial future, building a plan today is the smartest step forward. Financial planning, once embraced, proves to be the steady compass that guides decision-making, protects families, and opens doors to ambitious dreams.

Contact the Experts at Artifex Financial Group

If you’d like to learn more about how financial planning could benefit your financial well-being, contact the team at Artifex Financial Group.

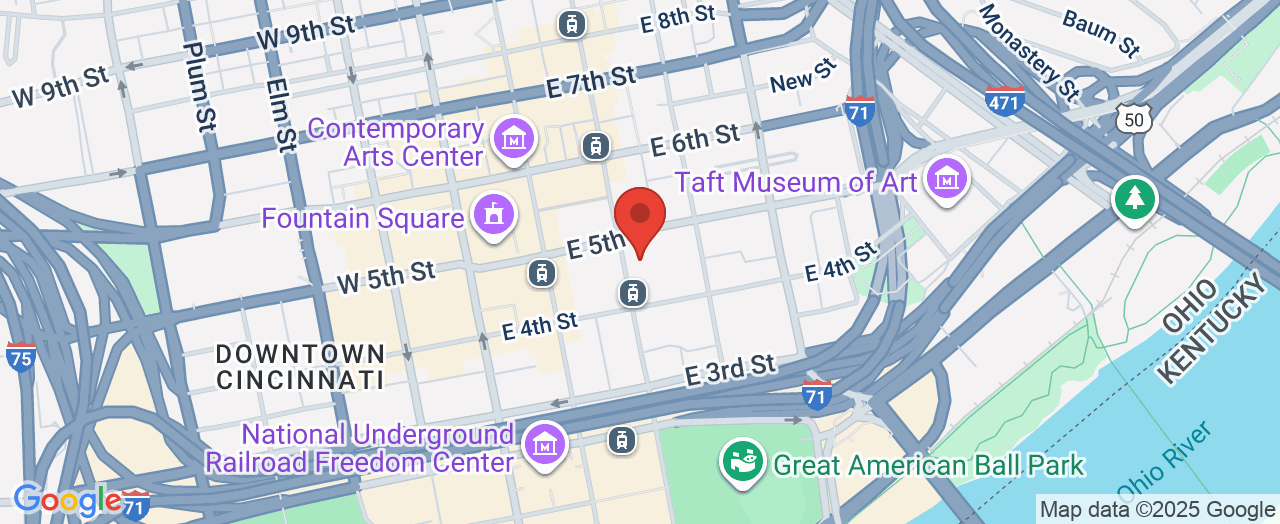

📍 Address: 201 E 5th St, Cincinnati, OH 45202

📞 Phone: +1 513-276-4366

🌐 Website: http://www.artifexfinancial.com/

Artifex Financial Group Location and Availability

🕒 Hours of Operation:

📅 Monday: 9:00 AM – 5:00 PM

📅 Tuesday: 9:00 AM – 5:00 PM

📅 Wednesday: 9:00 AM – 5:00 PM

📅 Thursday: 9:00 AM – 5:00 PM

📅 Friday: 9:00 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment