Navigating Uncertainty: Why Retirement Planning Matters More Than Ever

Imagine reaching your golden years only to discover that your savings fall short of your needs—or that unpredictable life changes have upended your security. That's the reality for many Americans who underestimate the importance of proactive retirement planning. With rising life expectancy and increasing financial complexity, getting retirement wrong isn't an isolated problem; it's an urgent, widespread challenge. The consequences ripple through quality of life, family stability, and peace of mind.

In today's world, the term "retirement planning" means far more than stashing money in a savings account and hoping for the best. It's become an absolute necessity for anyone who wants clarity and control in shaping their destiny beyond work. The stakes are high: from fluctuating markets to evolving healthcare costs, every choice you make today can dramatically impact your tomorrow. Understanding retirement planning isn’t just sensible—it could be transformative. Tackling retirement with insight and preparation is no longer a privilege for the few; it’s an essential safeguard for everyone seeking a secure future.

Beyond the Basics: Retirement Planning as a Dynamic and Essential Process

Retirement planning goes far beyond simple budgeting or guessing at future needs—it's a methodical process, informed by expertise, designed to navigate an increasingly complex world. At its core, retirement planning involves setting personal goals, mapping out actionable strategies, and constantly adapting to new circumstances. It's taking the abstract questions—Will I have enough? What do I want my life to look like?—and constructing concrete answers rooted in data, experience, and foresight.

The landscape of retirement planning is filled with nuances that the average person may overlook. For instance, failing to account for medical expenses, inflation, or family needs can leave well-meaning savers vulnerable to shortfall. Missed opportunities for growth, inefficient tax strategies, or a lack of diversified investments can lead to stress and regret later. Those who lack clarity or delay planning often face difficult decisions with fewer options. The key difference lies in an informed, consultative approach—one that prioritizes adaptability and holistic management—allowing individuals to retire with confidence and renewed purpose. For anyone still wondering if it’s worth the time and effort, the answer becomes clear: Not educating yourself on retirement planning is a risk you can’t afford to take.

Why Comprehensive Retirement Planning Unlocks Financial Confidence and Peace of Mind

Drawing on a blend of tradition and innovation, expert retirement planning provides far more than a simple roadmap to the future—it offers peace of mind and the ability to thrive amid change. MAI Capital Management, for example, operates as a dedicated fiduciary, weaving authenticity, diversity, and purpose into every client interaction. This approach ensures that retirement strategies are not just personalized, but also responsive to evolving life circumstances.

The greatest benefit of robust retirement planning is empowerment. Individuals and families are equipped to sidestep the pitfalls of uncertainty, make informed decisions in volatile markets, and prepare for long-term goals such as legacy building or charitable giving. With guidance rooted in a consultative, advisory process, clients can expect comprehensive wealth management—touching every aspect of their financial worlds, from investment strategies to estate planning. The end result is more than just financial security: it’s the confidence to pursue new adventures, support loved ones, and experience each day in retirement with autonomy and joy.

From Cookie-Cutter to Custom Strategy: How Advisory Retirement Planning Sets a Higher Standard

Not all retirement plans are created equal—and the difference lies in expertise and intention. Advisory-driven planning, exemplified by firms with in-house teams that blend boutique agility with the robust resources of established leaders, offers a higher standard of financial stewardship. These teams act as fiduciaries, prioritizing client interests while cultivating genuine relationships to understand unique goals and concerns. It’s a partnership, not a transaction.

By integrating advanced analytical tools and ongoing financial literacy resources, advisors help clients proactively address changes in their circumstances or in the market. This means more than checking boxes on a worksheet—it’s about scenario planning, stress-testing portfolios, and guiding families through significant life transitions. Clients can feel confident knowing their plan is both comprehensive and flexible enough to withstand surprises, ensuring that retirement isn’t just survived, but truly enjoyed.

Building Security in a Changing World: The Critical Role of Fiduciary Partnership

As economic landscapes shift, so do the requirements for a robust retirement plan. Trusted advisory firms distinguish themselves by acting not only as planners, but as true partners in their clients’ lives. Their mission is to shape the future of advice, making a significant and positive impact on client well-being through transparency, ongoing education, and holistic support. This philosophy turns what could be a daunting process into an empowering journey.

In a world where regulations, markets, and personal circumstances can change overnight, having a dedicated advocate in your corner is invaluable. Fiduciary advisors are there to reassess strategies as needed, provide insight when new challenges arise, and celebrate successes along the way. Their commitment extends far beyond numbers on a spreadsheet—it's about helping clients achieve the milestones that matter most, with integrity and empathy.

Financial Literacy: The Hidden Power Behind Effective Retirement Planning

One frequently underestimated asset in retirement planning is financial literacy. Skilled advisors place a premium on educating clients, empowering them to make informed choices instead of feeling lost in jargon or complexity. This educational spirit demystifies investing, clarifies tax implications, and breaks down the mechanics of planning for emergencies or legacy goals. It turns an opaque and stressful task into one of clarity and confidence.

As clients become more literate in financial matters, the benefits multiply: fewer costly mistakes, proactive identification of opportunities, and less anxiety in the face of market volatility. The end result isn’t just a solid retirement plan—it’s peace of mind, knowing that you have the knowledge and support to weather any storm.

Inside the Advisory Mindset: MAI Capital Management’s Distinctive Approach to Retirement Planning

MAI Capital Management exemplifies an approach to retirement planning that is as compassionate as it is comprehensive. The firm operates under a mission-driven model, acting as partners and fiduciaries for every client. Authenticity, diversity, and purpose are interwoven into their advisory process, fostering long-term relationships and a genuine understanding of individual client needs. This combination of boutique personalization and robust leadership resources elevates the retirement planning experience from routine to remarkable.

The firm believes in making a significant and positive impact on the well-being of its clients, seeing financial planning not as a series of one-time events, but as an ongoing journey. Their in-house team leverages a range of backgrounds—from MBAs and CFPs to JDs and CFAs—ensuring that every retirement strategy is informed by seasoned, multidimensional expertise. MAI Capital Management’s commitment to shaping the future of advice creates an environment where financial confidence and client empowerment go hand in hand.

When Success Stories Inspire: A Glimpse Into Real-World Impact

While the technical advantages of retirement planning are clear, the true value often shines through in the experiences of those who have taken charge of their futures. Consider the story reflected in this review—an authentic example that illustrates both the process and the outcome of client-centered advisory:

For those ready to take their first step into retirement planning, these real-life experiences serve as powerful validation. They highlight not only the importance of expert guidance but also the personal growth, security, and confidence that come from proactive, well-informed action.

What Retirement Planning Could Mean for Your Next Chapter

Retirement planning may seem like a distant concern until it becomes an urgent necessity. As economic conditions shift and life circumstances evolve, the value of a thoughtful, expertly crafted plan only grows. Advisory firms like MAI Capital Management bring a unique blend of partnership, expertise, and educational focus to every client’s journey—ensuring retirement is approached not with fear, but with optimism and purpose. As you consider your future, remember that retirement planning is more than a financial exercise; it’s your opportunity to define, pursue, and enjoy the lifestyle you’ve always imagined.

Contact the Experts at MAI Capital Management

If you’d like to learn more about how retirement planning could benefit your financial future, contact the team at MAI Capital Management.

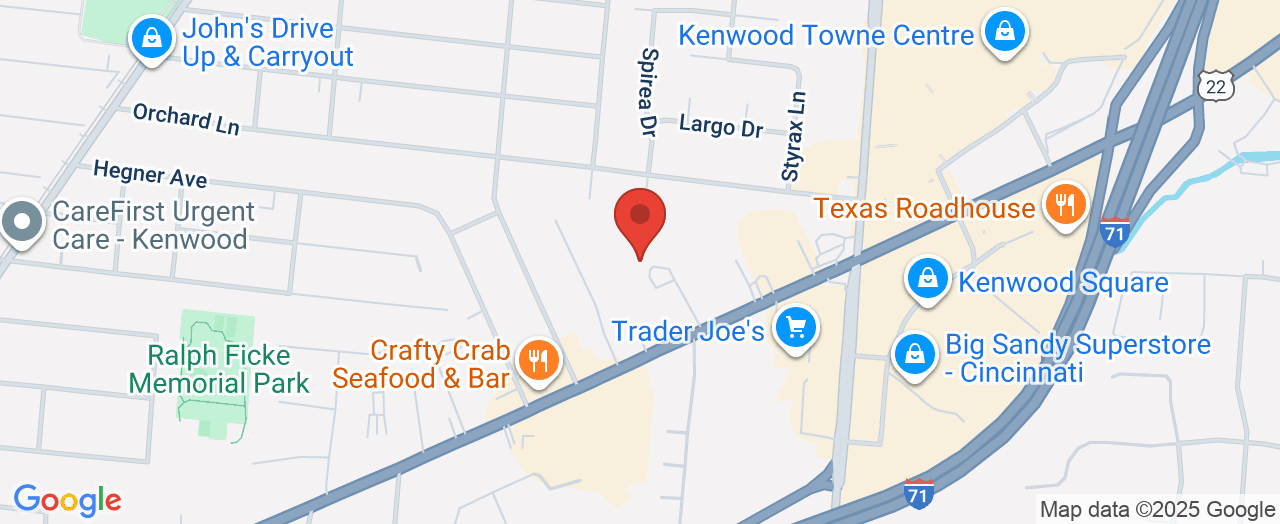

📍 Address: 7755 Montgomery Rd, Cincinnati, OH 45236

📞 Phone: +1 513-871-4555

🌐 Website: https://mai.capital/location/cincinnati-oh/

MAI Capital Management Location and Availability

🕒 Hours of Operation:

📅 Monday: 9:00 AM – 5:00 PM

📅 Tuesday: 9:00 AM – 5:00 PM

📅 Wednesday: 9:00 AM – 5:00 PM

📅 Thursday: 9:00 AM – 5:00 PM

📅 Friday: 9:00 AM – 4:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment