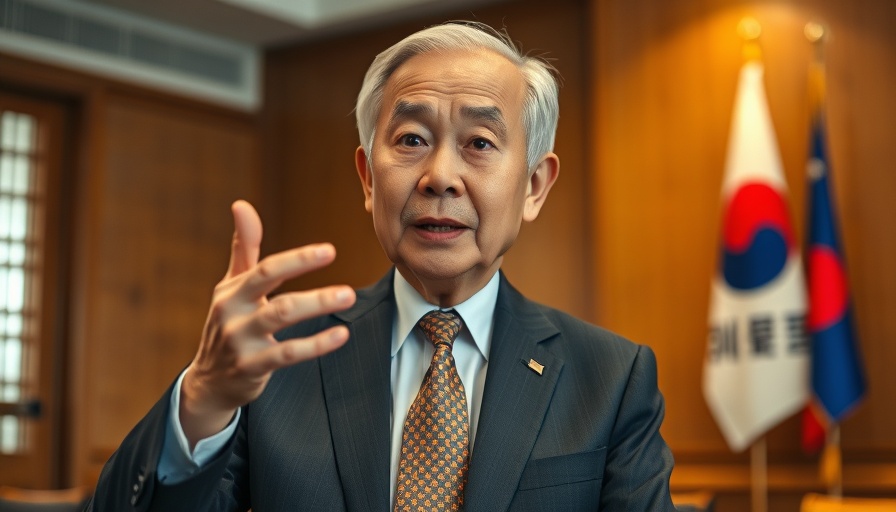

South Korea's Approach to U.S. Trade Tariffs: A Strategic Decision

In a notable shift, South Korea's acting president recently announced that the country will not "fight" the tariffs imposed by former President Donald Trump. Instead, South Korea is adopting a conciliatory approach, aiming to maintain stability in trade relations with the United States, a crucial economic partner. This decision highlights the complexities of international trade in the face of protectionist measures.

Understanding the Impact of Tariffs on Trade

Tariffs, which are taxes imposed on imported goods, can significantly alter trade dynamics. They are often used to protect domestic industries from foreign competition but can lead to increased prices for consumers. South Korea's trade with the U.S. has historically been beneficial for both nations, and the decision to forgo a confrontation regarding tariffs suggests a desire to preserve that relationship. By rolling with the punches rather than escalating tensions, South Korea aims to foster dialogue over conflict, prioritizing long-term economic stability.

Historical Context: Trade Relations Between South Korea and the U.S.

The relationship between South Korea and the U.S. has evolved significantly since the ratification of the Korea-U.S. Free Trade Agreement in 2012. This agreement opened markets and created economic opportunities for both countries, strengthening their ties. However, recent years have seen fluctuating attitudes toward trade, particularly under the Trump administration, which emphasized 'America First' policies. South Korea’s current stance on tariffs reflects a pragmatic understanding of this evolving landscape.

What This Decision Means for South Korean Businesses

For South Korean businesses, the decision to not oppose the tariffs directly is a double-edged sword. On one hand, avoiding retaliatory measures may protect them from severe disruptions in trade; on the other, it leaves them vulnerable to the financial impacts of tariffs on exports to the U.S. Small businesses in particular, which often lack the resources to absorb increased costs, could face significant challenges if tariffs continue to rise without resolution.

Future Predictions and Economic Outlooks

Looking ahead, South Korea’s trade policy may influence global trade trends as other nations observe how it navigates this situation. Experts predict that if South Korea successfully maintains its trade relationship with the U.S. despite current tariffs, other countries could adopt similar strategies to mitigate the adverse impacts of tariffs. This might lead to a more collaborative approach to international trade moving forward.

Counterarguments: What Critics Are Saying

Critics of South Korea's decision argue that not challenging tariffs might embolden further protectionist policies from the U.S. They stress that a more assertive stance could have opened doors for renegotiations and stronger trade conditions. The debate centers around whether it’s better to take a stand against unfair trade practices or to employ strategic patience to safeguard existing relationships.

Common Misconceptions About Tariffs and Trade

Many people may believe that tariffs represent a winning strategy for domestic economies. However, the reality can be more nuanced. Tariffs not only protect certain industries but can also trigger retaliation from other countries, potentially leading to a trade war. Understanding the multifaceted effects of tariffs is critical for consumers and businesses alike.

In light of these complexities, readers should remain informed about international trade policies and their potential impact on local economies. Following developments in U.S.-S.Korean trade relations will be crucial in understanding how these changes may affect everyday financial decision-making.

In conclusion, South Korea’s approach to Trump’s tariffs reflects a delicate balancing act of prioritizing economic stability while navigating international challenges. As businesses and consumers alike experience the ripple effects of these policies, it’s essential to stay informed and adaptable to the evolving trade landscape.

Add Row

Add Row  Add

Add

Write A Comment