Mortgage Rates Maintain Multi-Week Lows: What's Next?

As the mortgage market fluctuates, consumers and industry professionals alike have been monitoring recent trends with increasing interest. Last week, mortgage rates experienced a significant relief as they dipped to their best levels since mid-September, reaching an average of 6.31% for a 30-year fixed mortgage according to Mortgage News Daily. This new multi-week low could present opportunities for potential buyers and those looking to refinance, even amidst the backdrop of persistent economic uncertainties.

The Current Landscape: Rangebound Rates in a Volatile Economy

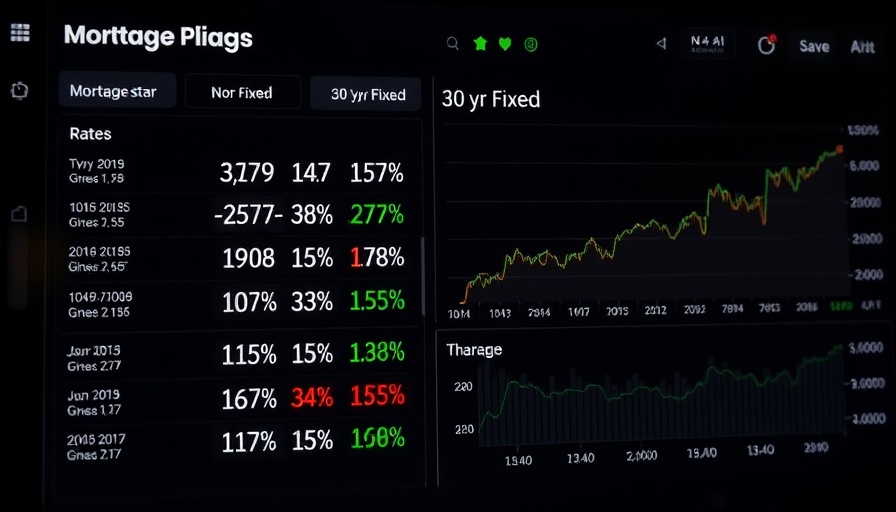

Mortgage rates have maintained their position within a tight range between 6.31% and 6.39% over the past several weeks. Notably, a speech by Treasury Chairman Jerome Powell could have influenced shifts in the market, yet the overall volatility seems limited due to the ongoing government shutdown. Experts believe that unless major factors change—like unexpected economic indicators or movements from the Federal Reserve—rates are likely to remain stable in the short term. According to a recent Bankrate poll, 50% of respondents anticipate that mortgage rates will remain steady, while 33% predict a slight drop.

Diverse Opinions: Where are Mortgage Rates Headed?

Reports indicate varying predictions for the direction of mortgage rates. While pundits like Robert J. Smith highlight the risks of a protracted government shutdown impacting buyer sentiment, others see a light at the end of the tunnel thanks to easing inflation and modest economic growth. Glen Luke Flanagan at Fortune mentions that while rates surged earlier this year, buyer strategies, such as negotiating rate buydowns on newly constructed homes, have emerged as viable options for maintaining affordability in this shifting landscape.

Trust the Data: Understanding Market Signals

To navigate these trends, consumers must pay close attention to significant market signals. Data from Optimal Blue indicates that while the average rate for a 30-year, fixed-rate mortgage is sitting at approximately 6.296%, it’s essential to move beyond averages and explore personalized rate offerings from various lenders. Moreover, comparing mortgages across large banks, credit unions, and other financial institutions significantly impacts potential savings. Freddie Mac states that potential savings from shopping around can range between $600 to $1,200 annually, an incentive not to be overlooked.

Impact of Economic Factors: The Broader Context

The broader economic milieu plays a crucial role in determining mortgage rates. Current dynamics, including the national debt and overall inflation, serve as critical drivers influencing lender behavior. Historically, periods of inflation resulted in upward adjustments of mortgage rates to safeguard lender profits. As experts point out, national economic health directly correlates with consumer ability to secure affordable home loans, thus keeping a close eye on the labor market and inflation trends is prudent.

Your Financial Profile Matters: How to Secure the Best Rate

Securing the best mortgage rate is not solely contingent on market trends; rather, individual financial health plays a crucial role. Prospective buyers should work to ensure their credit scores are exemplary, keeping in mind that scores of 740 or more can score the most advantageous rates. Additionally, maintaining a competitive debt-to-income ratio and getting prequalified with multiple lenders will equip borrowers with the best tools for negotiating rates and terms.

From Pandemic Low to Economic Reality: A Historical Perspective

Mortgage rates today contrast sharply with the record lows observed earlier in the pandemic. In January 2021, rates plunged to an unprecedented average of 2.65%, but economic conditions have since shifted dramatically, and experts do not expect a return to those lows in the foreseeable future. Historical analysis shows that the rates currently hovering around 6% are not unprecedented when considered against broader longitudinal data.

In conclusion, navigating the current mortgage landscape requires both vigilance and strategy. As lenders adjust to ongoing economic changes, potential homebuyers should leverage comparative insights and engage proactively with lenders to secure the best terms. Whether you’re a first-time buyer or looking to refinance, keeping abreast of rates and understanding your financial standing remains crucial in this evolving market.

Stay informed about the latest developments and consider consulting a finance expert to help you decode the noise in the mortgage rate sector. Equip yourself with knowledge and tools to make informed decisions about your financial future.

Add Row

Add Row  Add

Add

Write A Comment